O nas

VODSTVO

NAŠI TRGI

SKLADNOST POSLOVANJA

Izberite regijo in jezik

Izberite regijo in jezik

Ocena nakupa

Ocena temelji na osnovi desetih analitikov, ki močno priporočajo nakup delnice NLB.

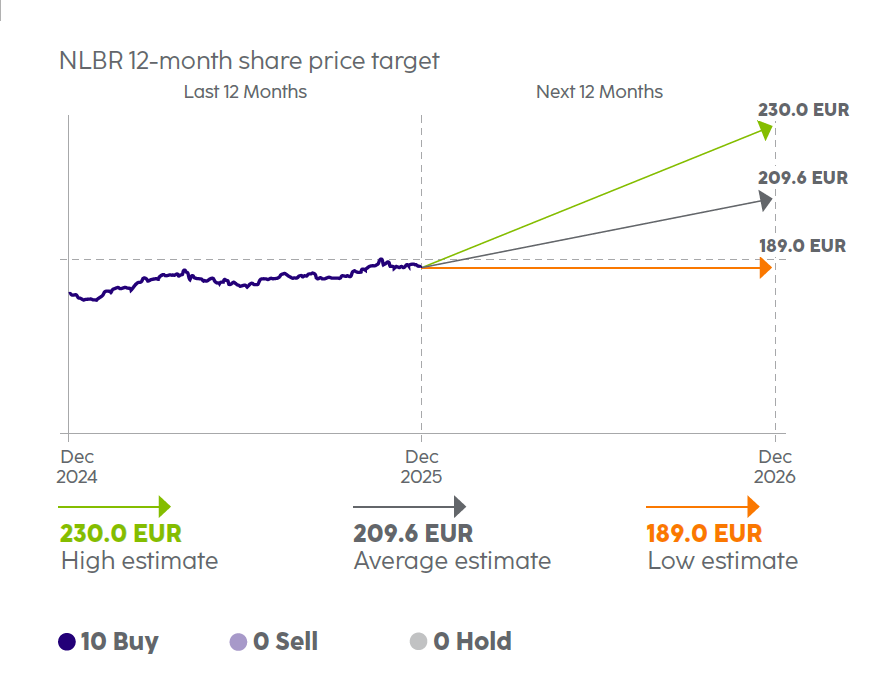

Napoved vrednosti delnice

Srednja ocenjena vrednost gibanja delnice NLBR po ocenah 10 analitikov je postavljena pri 209.6 EUR za delnico.

| Income Statement (EURm) | Q4 | 2025E | 2026E | 2027E | ||||

|---|---|---|---|---|---|---|---|---|

| Median | Average | Median | Average | Median | Average | Median | Average | |

| Net interest income | 241.0 | 241.0 | 944.0 | 945.9 | 1,007.7 | 990.3 | 1,031.5 | 1,036.5 |

| Net fee and commission income | 86.0 | 86.7 | 337.6 | 335.2 | 362.9 | 360.1 | 388.9 | 384.7 |

| Other operating income | 3.2 | 1.8 | 14.1 | 17.7 | 7.0 | 14.8 | 9.0 | 18.0 |

| Net Non-interest income | 89.0 | 88.5 | 351.7 | 352.9 | 369.1 | 374.9 | 402.5 | 402.7 |

| Total net operating income | 331.4 | 329.5 | 1,291.2 | 1,298.8 | 1,378.7 | 1,365.2 | 1,427.2 | 1,439.3 |

| Employee costs | -100.4 | -100.5 | -355.9 | -352.2 | -375.6 | -370.5 | -384.9 | -384.1 |

| Other general and administrative expenses | -61.1 | -61.8 | -211.2 | -213.6 | -213.8 | -220.3 | -221.0 | -227.8 |

| Depreciation and amortisation | -17.2 | -17.2 | -65.9 | -65.1 | -67.8 | -66.8 | -68.1 | -67.5 |

| Total costs | -181.0 | -179.4 | -623.5 | -630.9 | -657.5 | -657.6 | -683.4 | -679.4 |

| Balance sheet tax | -8.5 | -8.5 | -33.0 | -33.8 | -35.0 | -35.9 | -36.5 | -38.1 |

| Result before impairments and provisions | 144.9 | 141.6 | 635.0 | 634.1 | 686.6 | 671.7 | 707.4 | 721.8 |

| Net impairments and provisions (sum of below) | -39.3 | -37.9 | -54.3 | -54.4 | -76.0 | -76.8 | -82.4 | -85.7 |

| Impairments and provisions for credit risk | -33.6 | -33.7 | -46.7 | -43.4 | -62.9 | -64.7 | -70.0 | -73.2 |

| Other impairments and provisions | -6.3 | -7.8 | -9.0 | -9.9 | -12.6 | -12.2 | -12.8 | -12.5 |

| Gains less losses from capital investments in subsidiaries, associates and JVs | 0.6 | 0.8 | 2.0 | 2.1 | 2.0 | 2.0 | 2.5 | 2.5 |

| Result before tax | 104.3 | 104.2 | 586.8 | 581.7 | 596.8 | 596.9 | 618.5 | 638.6 |

| Income tax expense | -14.2 | -14.0 | -79.0 | -75.3 | -79.1 | -79.2 | -90.8 | -89.9 |

| Non controlling interests | -3.6 | -3.8 | -15.3 | -15.6 | -14.0 | -15.1 | -14.2 | -15.5 |

| Net profit attributable to shareholders | 87.5 | 86.4 | 493.5 | 490.8 | 503.6 | 502.6 | 519.4 | 533.3 |

| Key Ratios | 2025 | 2026 | 2027 | |||

|---|---|---|---|---|---|---|

| Median | Average | Median | Average | Median | Average | |

| NPL ratio | 1.7% | 1.8% | 1.7% | 1.7% | 1.7% | 1.7% |

| Net loans to deposits | 77.7% | 77.7% | 78.8% | 78.7% | 80.0% | 79.8% |

| CET1 ratio | 15.1% | 15.3% | 15.2% | 15.5% | 15.5% | 15.6% |

| T1 ratio | 15.6% | 15.8% | 16.2% | 16.3% | 16.2% | 16.4% |

| Total capital ratio | 18.9% | 19.1% | 19.4% | 19.4% | 19.1% | 19.6% |

| Loan growth | 12.7% | 13.0% | 7.8% | 7.7% | 7.5% | 7.0% |

| Deposit growth | 8.0% | 7.3% | 6.5% | 6.3% | 6.0% | 5.6% |

| Net interest margin | 3.26% | 3.26% | 3.16% | 3.18% | 3.14% | 3.16% |

| Cost of risk | 0.27% | 0.24% | 0.30% | 0.32% | 0.35% | 0.35% |

| Cost to income ratio | 48.2% | 48.6% | 47.7% | 48.2% | 47.2% | 47.0% |

| ROA | 1.7% | 1.7% | 1.6% | 1.6% | 1.6% | 1.6% |

| ROTE | 15.0% | 14.8% | 13.9% | 14.0% | 14.1% | 14.0% |

| RWA | 19,523 | 19,546 | 20,804 | 20,750 | 22,410 | 22,045 |

| Dividends (per share, €) | 12.86 | 12.86 | 13.53 | 13.26 | 14.41 | 14.24 |

Vaša prijava je bila uspešno sprejeta

Hvala, ker ste se naročili na sporočila za vlagatelje.

Opravičujemo se, prišlo je do težave pri obdelavi vašega povpraševanja. Prosimo, poskusite znova.

Seznam za primerjavo je prazen

Na primerjalnem seznamu ni shranjenih izračunov. Za primerjavo morate dodati nekaj izračunov.